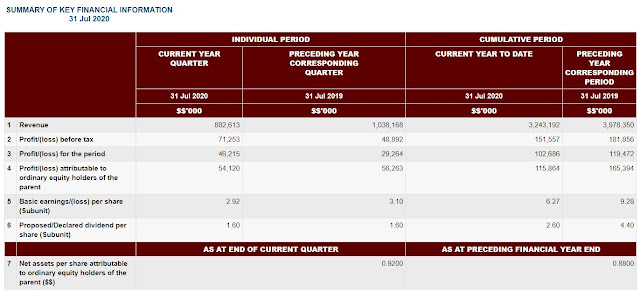

The Q4 FY20 revenue of RM882.6mil was 15% lower compared to preceding year corresponding quarter. PBT meanwhile grew 45.7% to RM71.3mil. The improved earnings for the current quarter despite decrease in revenue was mainly attributable to much smaller losses from the operations in China following restructuring and streamlining of operations by adopting an asset-light and lower-cost model.

For the financial year ended 31 July 2020, the Group recorded a revenue of RM3,243.2 million, a decrease of RM735.2 million or 18.5% as compared to RM3,978.4 million recorded in the preceding year. Profit before tax stood at RM151.6 million, having dropped by RM30.3 million or 16.7% over the same period.

The reduced earnings for the cumulative quarters was mainly due to losses of RM26.9 million incurred during the temporary closure of factories following the Movement Control Order (“MCO”) that was imposed in the preceding quarter, in addition to lower orders from a key customer.

Malaysia segment Q4 FY20 result had surpassed my estimation as mentioned in previous post. PBT was RM93mil compared to my prediction of RM55mil. However, Indonesia and China Segments were having losses serious than I thought. Although Indonesia expected to record 2nd write off of RM2.6mil, the net loss after excluding the write off was actually worsen. No statement was made by the management on the increase in the loss for China segment.

A summary compilation of research houses' analysis reports from VSI's briefing:

The floor care products has reaching the end-of product life cycle and we might see lower order flow from UK customer (Customer X). But the short fall orders can be covered by the newly secured motorized printed circuit board assembly (PCBA) and box-build jobs, in Aug 2020, which contributing RM200mil to FY21's top line. Production is set to begin in Dec 2020. Key customer X had contributed about 40% to VSI's FY20 revenue.

VSI currently produces three models for US-based customer (Customer B), with two more slated for production by Dec 2020 and early 2021 respectively. On top of that, four additional models were secured and will begin production by 2HFY21 bringing a total of 9 models confirmed for this customer. Due to the better orders flow, VSI had allocated a further 180k sqft to cater for customer needs, on top of the current 160k sqft. The Aminvestment mentioned the group may potentially secure up to a total of 12-13 models.

Expecting higher sales orders in FY21 from coffee brewer and pool cleaning customer due to increase in demand post-lifting of Covid 19 and at-home consumption and some order diversions from China. Coffee brewer contributed 22% to VSI's FY20 revenue. While VSI achieved a record revenue of an estimated RM200mil from pool cleaning customer in FY20. FY21 revenue contribution from pool cleaning customer is targeted to increase by 50% YoY on higher orders in the pipeline. Among VS customers, pool cleaning customer dominates the highest margin of all.

VSI recently secured the new US-based customer; Victory in Aug 2020. Currently the group is in the midst of completing the mold fabrication and tooling and targets to commence production of its two spray models by Q1FY21.

Comments:

- We can only focus on Malaysia segment businesses as the board is actively looking to expand its current production capacity to cater for future orders from the US-based customer (Customer B) and future prospective clients. I don't expect any profit could be achieved from Indonesia and China segments in FY21.

- Expecting Q1FY21 revenue to increase compared to Q4 FY20 primarily contributes from Victory and US-based customer (Customer B) that cushion the slow down from UK customer orders.

- Q1 usually is the peak season for VSI. Hence, with all those prospective orders mentioned in analysis reports, I am positive on the coming PBT to record RM85mil an increase of 20% from Q4 FY20 and reckon a EPS of 3.09sen for Q1FY21 with a 10% discount rate.

- By anticipating 5% profit margin gain from Malaysia segment in Q1 FY21 as compared to Q4 FY20, Indonesia segment will remain lower loss around RM3.9mil with the absent of impairment loss and China segment to be remained slightly higher loss on RM8.6mil in Q1 FY21.

- Current PE of 42 at RM2.60 (13/12/20) is way higher than my expectation in earlier post. It turns out PE 42 is still around the average value, as the recent EMS player stock prices have been quite bullish. - I reckon that FPE will further reduce to 38.8 with the accumulate EPS of 6.70sen (3.09sen[F]+2.87sen-1.05sen+1.79sen)

- Target Price = RM2.68 with PE= 40.

Technical Analysis

Upcoming earning result is just around the corner, the bullish trend starts to lose its momentum.

MACD is about to make negative crossing and its moving trend is showing a divergence pattern with price trend, which is not a good sign to trade.

The next support line is around RM2.50 for the chart to retest the breakout point. If the price cannot rebound on this price but moves below the support line I would take profit on my holding with a potential of additional 3.2% drop. While the price rebounds, a good profit of 11% to the next resistance point at RM2.79 which it is worth to top up at this point for short term trading.

Overall, the price is already ahead of the fundamental. Unless VS can provide more positive news to stimulate the uptrend momentum such as getting new prospective clients with higher margin or bonus issues. It might not be a good price to hold for long term as of now.

No comments:

Post a Comment