FPI reported a higher revenue of RM281mil, an increase of 7.8% from the previous corresponding period last financial year. Thanks to higher sales volume recorded which was aligned with the comments from the board during AGM.

The group mentioned that the higher sales volume has resulted in higher earnings before interest, tax, depreciation and amortization (EBITA) of RM36.8mil for the current quarter compared to RM24mil in the previous year's corresponding quarter.

The management has done a better cost control under Q3 to reduce the distribution costs, administrative expenses and other expenses.

Gross margin has achieved a greater improvement from 11% in previous corresponding period last year to 15%.

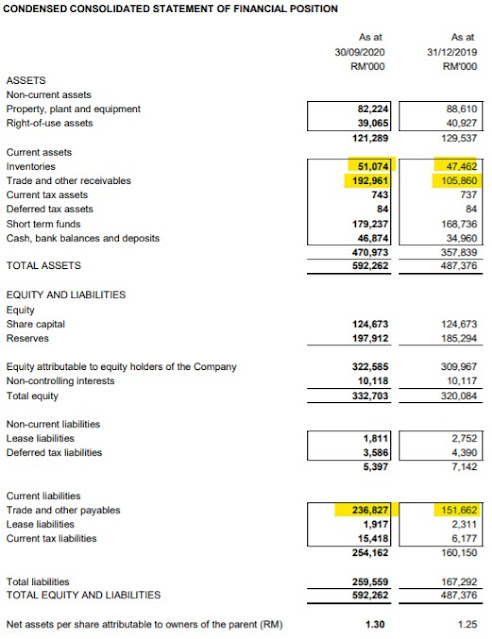

Referring to the latest balance sheet, total assets and liabilities have increased compared to last financial year. The increase was primarily contributed from higher trades, other receivables and other payables which showing us FPI is making more sales transactions. It would possible to carry forward to next quarters and realize in sales revenue.

Cash flows from operating activities has turned into positive in Q3 FY20 compared to previous two quarters were recorded with negative cash flow and it recorded a higher net cash compared to last year.

Hence, I expect management will pay higher dividend for FY20.

Financial year-to-date ended 30 September 2020

For the 9-month period ended 30 September 2020, the Group recorded 13.1% lower sales at RM513.2 million compared to RM590.9 million in the previous year’s corresponding period as the Group shut down its operations from 18 March 2020 in compliance with the Movement Control Order (“MCO”) imposed by the Government of Malaysia in an effort to contain the outbreak of COVID-19 pandemic. The Group resumed its operations at end of April 2020. Nevertheless, the Group recorded higher EBITDA of RM60.0 million for the 9- month period ended 30 September 2020 compared to RM51.6 million in the previous year’s corresponding period mainly due to change in sales mix.

The Group recorded significantly higher sales of RM281.0 million or an increase of 161.2% in the current quarter compared to RM107.6 million in the immediate preceding quarter mainly due to higher sales volume. As such, coupled with better economies of scale, this has resulted in higher EBITDA of RM36.8 million as compared RM13.9 million in the immediate preceding quarter.

Comments:

- The management has made its promises during AGM that sales order will return during Q3 as normally FPI has its peak season during this quarter with slightly lower profit margin due to 3 new products introduced. Moreover, under this pandemic situation, such financial performance is beyond my expectation as I only anticipated that FPI might able to sustain the profit margin similar to last year. Well, this is a good management and be very cautious with their business.

- Operating costs did come down, as management did explained that implementing automation and machinery to their new products.

- In earlier post, I reckon that FY20 EPS to be 14.7sen. Q3 FY20 performance has already exceeded my prediction. Hence, I would expect a higher EPS to be achieved in FY20 at 18.58sen.

FY20 EPS = 2.2sen + 1.98sen + 10.4sen + 4.0sen (Forecast)

By taking PE = 12, Target price = RM2.23

Assuming that 65% dividend payout rate, FY20 I am looking at a 12sen DPS.

After dividend adjustment, expected TP = RM2.11. with 6.5% DY at current price of RM1.85 (19/11/2020)

Technical Analysis

Currently stock price is moving in a bullish trend, as hot money has returned to this stock. Next support line would be RM2.04 and resistance line at RM1.78.

By comparing the uptrend of stock price since last quarter until now was just about 35%, but profit has increased 205% from RM8.5mil in Q2 FY20 to RM25.8mil in Q3 FY20. The uptrend is yet to consider overpriced as compared to the trending from glove sectors. Hence, I believe the stock price will able to meet the 2.618 fibo line at RM2.04.

No comments:

Post a Comment