Who is DIGI

Digi.Com Berhad is one of the big 4 telco company in Malaysia. According to Source: Statista 2020, Digi has 18% of telecommunication market share in Malaysia.

Up to date, Digi has 10.68mil active subscribers and its 4G LTE and LTE-A network coverage have grew to 91% and 74% of the population nationwide respectively, also with the recent launched fibre to the home (FTTH) solution, Digi has 9,850km of extensive fibre network to serve 3.7 million households.

Take a glance on Digi's financial performance indicators:

1. Digi has up to 99% dividend payout ratio, highest dividend yield among the telco companies.WOW!!

2. ROE of 206%!! Insane!!

3. EBITDA margin around 50% and market cap is standing at Rm30.945bil.

The financial performance was so nice that I believe it attracts many dividend stock hunters including me.

The company structure is quite simple.

49% of Digi's share owns by its mother company, Telenor group and Digi's top management is also controlled by Telenor staff. Top 30 largest shareholders are mostly foreign and local funds which holding 86.49% of total issued shares, very high entry level for retails to play!

Yup, Digi is not a local company and I am not supporting buatan malaysia so far😆

Hmm...Everything looks so good. Is it good to invest in Digi? Let's dig into the latest quarter report that released recently.

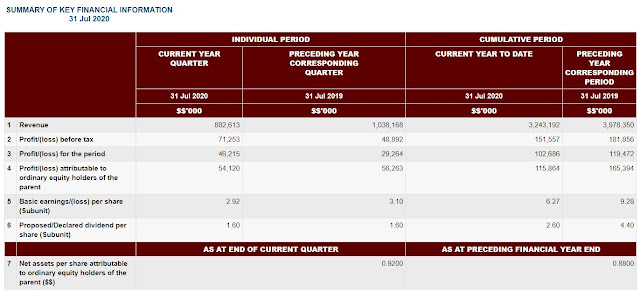

Digi reported a slight growth in revenue of 1.1% in current financial quarter as compared to previous corresponding financial quarter. However, PAT was down by 9.8%. Year to date, revenue was however trimmed by 0.6% to RM 4.59bil compared with the corresponding period last financial year of RM 4.62bil. PAT was also declined 13.7% Y-Y.

Under Q3 FY20, Digi reported higher mobile service revenue of RM1.374 bil, up by 4% compared to preceding quarter primarily contributed by the prepaid segment to offset softening postpaid revenue as postpaid market was challenged by involuntary churns and plan downgrades due to softer affordability. Postpaid ARPU trimmed marginally to RM67 on the back of lower roaming contributions on closed international borders and overall weaker consumer spending due to Covid-19 effected interconnect ARPU.

The prepaid subscriber base improved for the first time since 3Q 2019, thanks to the efforts by the management to grow its Malaysian base to offset the shrinking migrant business and their latest prepaid packages have meet consumer sentiments. Prepaid ARPU uplifted by RM4 Q-Q to RM33 alongside prepaid subscriber base expansion of 67k amidst heightened data competition. Digi recent product launches namely Digi Abadi and Digi Prepaid NEXT enabled price-conscious consumers to access to high speed internet connectivity via bite-size data passes.

Total subscriber base improved by 57k users to 10.7 million whilst blended ARPU escalated RM2 to RM42, underpinned by the prepaid resilience and innovative postpaid offerings that drove quality and loyal subscribers. Device and other revenues chalked up 51.9% QQ and 37.6% Y-Y on encouraging take-ups for renewed PF365 plans built in with greater savings and flexibility.

Digi is also launching FTTH service since Q4 FY19. However, there is no significant revenue recorded in the quarter report.

EBITDA margin slips to 50% compared to 53% in 3Q19 and 2Q20 respectively and 3QFY20 net profit fell by about 10% Y-Y due to higher device sales and the normalization of marketing cost. Meanwhile, opex increased by 3.9% Y-Y as the previous year included a non-recurring cost of RM17mil. Depreciation cost rose 6.8% Y-Y as Digi continues to invest in network expansion. Also an additional RM12mil provision for doubtful debt was recognized due to the group's commitment to manage bad debt risks in the current challenging economic environment.

Balance sheet summary

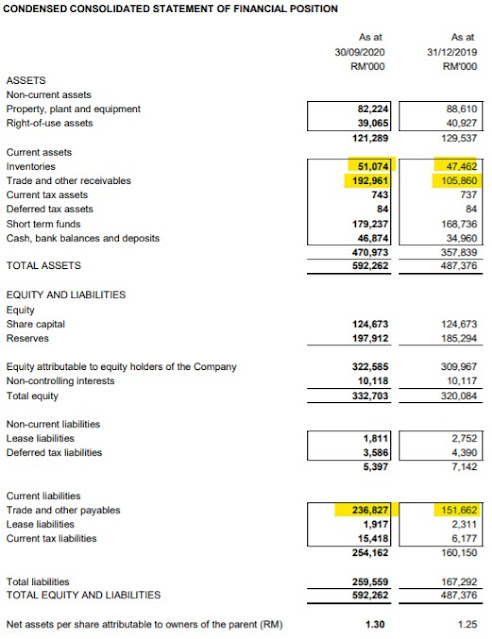

Total Assets as at 30 September 2020 contracted to RM8.04 billion on utilization of internally generated

funds for loan repayments. As a result, total borrowings trimmed to RM2.77 billion, of which 78.1% comprised of Islamic borrowings. Hence, total liabilities was reduced to RM7.39 billion.

A more detail summary was shown in the table, where cash & cash equivalents reduced from RM519 mil in previous quarter to RM365 mil contracting by 42.2%. Total equity was improved to RM644 mil but was lower compared to preceding year corresponding quarter.

Comments:

1. Personally I feel that Digi focuses on the low-end market as ARPU for postpaid and prepaid are lower compared to Maxis. But Digi manages to generate higher profit margin in such competitive market. Apparently, Digi is very focusing in cost optimization to maximize the return to shareholders especially its mother company. Hence, investing in Digi can enjoy the same profit as Telenor group.

In other word, Maxis has more room of improvement to expand its market share into the low-end market.

2. Would it be too late for Digi to join in fibre network market? Digi has partnered with Time DotCom to provide fibre footprint to more locations and can connect more malaysians residing in high-rise residential areas. With the same packages offering among three players, would Digi be a little too pricy? It might be the reason where no significant revenue was recorded since the package was launched back in Q4 FY19.

3. Continue shrinking in revenue, net profit as well as dividend payout has shied away traders. Telco industry is now facing a shift from voice & SMS to internet usage and from prepaid to postpaid that caused revenue to drop.

Looking at one year price trend, most of the telco stock prices are in negative return. Maxis and Digi were slightly above the telecommunications & media index. We can also spot that solid line connection (Fibre network) business provides more upside in stock price. Hence, it is clear that the fibre network business has more future capacity expansion compared to data internet business which has been quite saturated.

As a consumer, I have to agree that solid line can provide a more stable internet connection with unlimited and faster streaming speed compared to internet data plan provided by telco companies. As smart phone getting more important in our daily life, a more stable connection and faster streaming speed is essential. Hence, I can see Digi emphasizes on the network expansion work in order to enhance its network quality, widen its fibre footprint and also recently Digi announced a collaboration with ZTE Corporation for its nationwide Radio Access Network modernisation..and bla..bla..bla..In short, Digi spend more money to upgrade network facilities.

4. I anticipate that the Q4FY20 revenue will slowly pick up as the some additional sales will contribute from Phone Freedom 365 program as usually Q4 will have new handsets launching.

Technical Analysis

Price is moving in a major downtrend, lower low and lower high. Next support line is RM3.95, if the price breaks below, the next support line would be RM3.82.

At the moment, I still can't see any slow down on the downtrend. Although Digi provides good dividend payout but overall it is a loss making investment. I will continue to observe the financial performance to look for the entering point when business start to recover.

Conclusion

I expect higher sales from phone freedom program and higher prepaid subscription from the coming Q4FY20. Hence, I reckon that the EPS could be achieved at 4.2sen. As such a full year dividend would be around 16sen.

By taking PE at 25, TP should be RM4.08 and dividend yield of 3.92%.

Overall, it is not attractive to invest.