2020 is a remarkable year for Furniture Sectors!

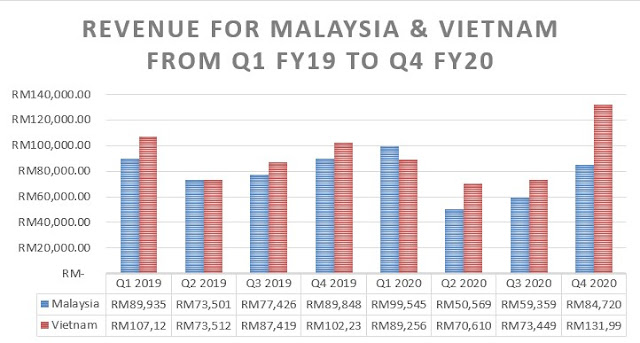

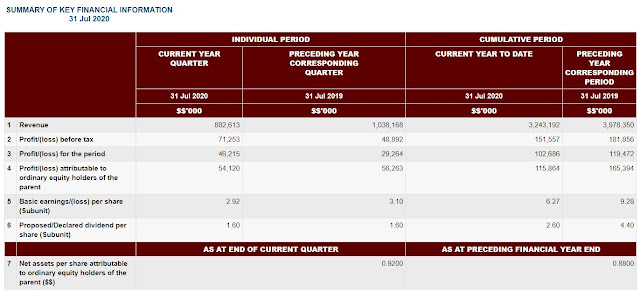

Pohuat reported a higher revenue achieved of RM216.72mil for the current quarter compared to RM192.08mil recorded in the preceding year corresponding quarter. Thanks to the continuous ramp up on production and shipment of furniture for both Malaysia and Vietnam operations. The sales order for current quarter under review was decent as the management highlighted the expected high demand in last quarter prospects.

As previous report, Pohuat had long dated orders from US importers and demand for home and home-office furniture will continue to be strong as the "stay and work from home" precaution is expected to prevail in the foreseeable future.

In line with the higher revenue the group recorded a 41.5% improvement for the current reporting period with a profit before tax of RM28.17 million compared to RM19.90 million recorded in the previous year’s corresponding reporting period ended 31 October 2019.

Despite a lower revenue recorded from Malaysian operations compared to previous year corresponding quarter, it achieved a marginally higher gross profit of RM19.23 million in the current reporting period compared to RM19.03 million in the previous reporting period. Gross profit margin improved to 22.7% during the current reporting period from 21.2% in the previous year reporting period due mainly to better handling of raw materials and lower selling expense. Profit before tax was marginally lower to RM11.26 million due to forex losses of RM1.06 million against a forex gain of approximately RM0.09 million previously.

Vietnamese operations registered markedly higher gross profit of RM27.20 million compared to RM16.09 million in previous year’s corresponding reporting period. Gross profit margin improved significantly to 20.6% from 15.7% previously as Vietnamese operations enjoyed across-the-board improvement in manufacturing costs due to lower material prices, better labour efficiency and better absorption of manufacturing overheads due to the higher level of production. Profit before tax increased by 81.2% to RM17.08 million during the current reporting period from RM9.43 million in the previous year’s reporting period.

Consistent with the recovery of demand and planned inventory building by US importers for the year end festive

seasons, shipment to US customers from both Malaysian and Vietnamese operations increased

substantially. In Malaysia, turnover grew by more than 40% whereas Vietnam’s turnover grew by a whopping

80%. On the Group level, absolute gross profit grew 82.7%, from RM25.50 million in the preceding reporting

period to RM46.58 million in the current reporting period. Gross profit margin improved from 19.2% to 21.5%

on the backdrop of stable raw material prices and better overhead absorption from the higher plant utilization

rate.

Company Prospects

"A survey by the US Conference Board indicates that consumers’ assessment of present-day conditions held steady following sharp recovery in consumer confidence in September 2020. Existing home sales continued to rise in October 2020 for the fifth straight month, a remarkable achievement amidst high unemployment due to the pandemic. It is also predicted that the 2021 home sales would rise 10% which should bode well for furniture sales."

"As a key furniture sourcing point, we have benefited with more orders being received from our customers for shipments all the way until Jun / July 2021. We are confident that demand for our products will remain strong in the coming year. Our shipments have been particularly strong over the last few months and we are now up to speed with our production schedule vis-à-vis new supply and logistic arrangement. As before, we are developing products to cater for the stay at home and work from home requirement. We are of the view that the global furniture trade will continue its growth in 2021 as we adapt to the new normal and global economy activities return to normalcy."

Comments:

1. Higher revenue and profit margin achieved in Q4 FY20 mainly due to higher sales orders from US customers and lower raw material cost which is aligned with prospects reported by the management in previous quarter. This shows that the management is quite transparent to shareholders.

2. Strong demand is expected to sustain as per management comment, shipment has scheduled until Jun/July 2021.

3. The management has also speed up their production, which is good that we would expect a continuous low operation cost for coming quarters.

4. Expecting 10% rise in furniture sales for 2021, the sales orders for Pohuat might see a slightly improvement next year. This quarter Q4 FY20, Vietnam operation has recorded the historical high revenue yet Malaysia operation seems decreasing, I would like to see what strategy Pohuat management would take to grab extra orders, should the management focus to expand Vietnam operation or fine tune Malaysia operation to increase production.

5. Production and sales are generally lower in Q1 & Q2 due to the local festive period as well as the summer holiday. The coming quarter result might not be higher than Q4.

6. Overall FY20 performance is better than my expectation. EPS was 28% higher than my prediction. By taking the FY20 EPS of 22.14sen

PE = 10

Target price = RM2.21, potential 24% upside form current price of RM1.78.

7. I reckon that the coming Q1 FY21 revenue would continue to sustain higher return and Malaysia operation would able to pick up, expecting Malaysia operation to achieve RM104mil and Vietnam to achieve RM108mil. The expected EPS for Q1 FY21 would be 6.21sen a 32% lower compared to Q4 FY20 by considering normalizing sales demand after year end festive seasons.

EPS = 6.21sen + 9.2sen + 4.88sen + 2.93sen = 23.22sen

PE =10

Target price = RM2.32, potential 30% upside from current price of RM1.78.

8. Net book value of RM1.82, which current price is still undervalued.

9. The improvement in assets and now Pohuat is having 76sen of net cash per share.

10. Higher dividend payout this year, although lower revenue achieved due to MCO interruption. A total of 9sen dividend payout for FY20 which is 5% DY on current price of RM1.78.

Key risks:

1. Normalize raw material costs and shipment costs will reduce future profit margin even though higher revenue could be achieved.

2. RM strengthen against USD. Earlier of Nov 2020, RM/USD price has broken out the major bearish trend. RM/USD continues to trend up and we would expect higher forex loss in coming Q1 FY21.

Technical Analysis